GST Filling

1. Who should register for GST?

GST registration is required:

- If you are a manufacturer or a trader and your turnover is above Rs 40 lakhs

- If you are a service provider and your turnover is more than 20 lakhs

- If you export goods or services then GST registration is mandatory irrespective of your turnover

- If you are into restaurant business and your turnover is more that Rs 20 lakhs per annum

- If you want to sell online through e commerce portal then GST registration is mandatory irrespective of your turnover

- If you supply goods in another state then GST registration is mandatory irrespective

2. If I have multiple offices should I register for GST for each Branch?

Yes GST registration is required for each office and each branch

3. What is the cost of GST registration?

The cost to register for GST is Rs 2000

4. What are your charges to file GST returns?

The charges to file GST returns start from Rs 1500/month and depends on the number of transactions every month

5. If I am selling on a online portal and my turnover is less than Rs 20 lakhs should I still register for a GST?

Yes to sell online on any portal like Amazon, Flipkart GST registration is mandatory irrespective of turnover

6. What are the documents Required for GST Registration?

- PAN of the Applicant

- Aadhaar card

- Proof of business registration or Incorporation certificate

- Identity and Address proof of Promoters/Director with Photographs

- Address proof of the place of business

- Bank Account statement/Cancelled cheque

- Digital Signature

- Letter of Authorization/Board Resolution for Authorized Signatory

7. What are the due dates for filing GST returns?

GSTR-1 (quarterly):

| Month | Due date |

| April-June | 31st July |

| July-Sept | 31st October |

| Oct- Dec | 31st January |

| Jan – Mar | 30th April |

GSTR-3B:

| Month | Due Date |

| April | 20th May |

| May | 20th June |

| June | 20th July |

8. How to register under GST?

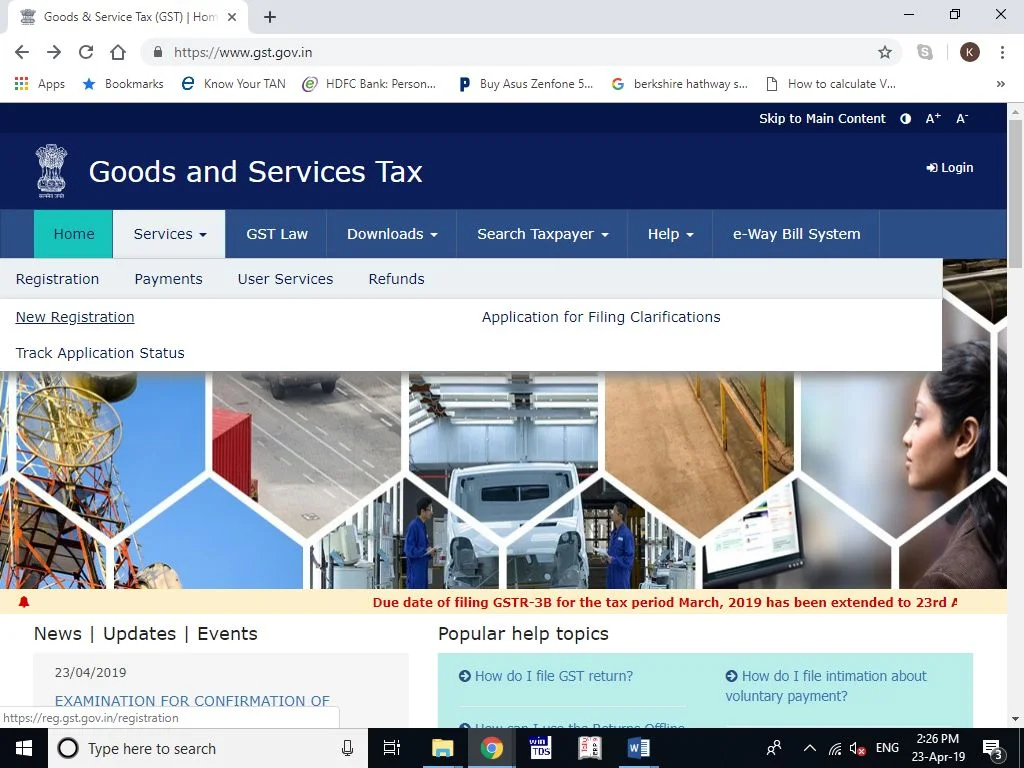

a. Go to GST Registration Website: https://www.gst.gov.in/

b. Click on Services Tab > Registration > New Registration

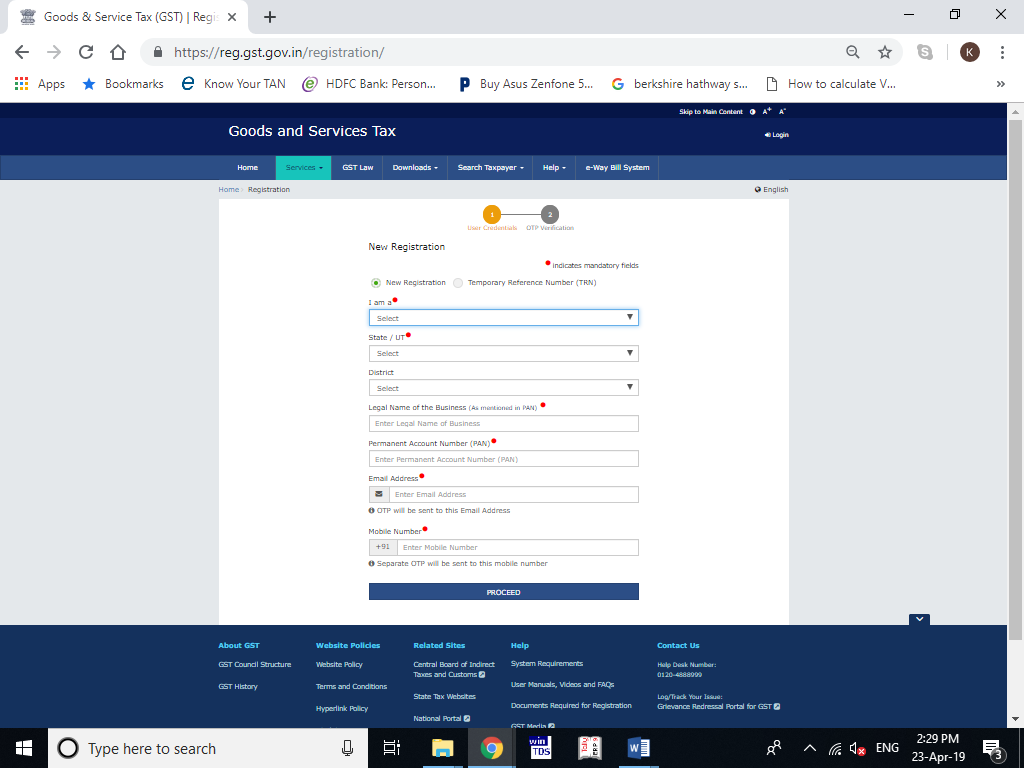

c. Enter the following details:

- In the drop-down under I am a – select Taxpayer

- In the drop-down under I am a – select Taxpayer

- Select State and District from the drop down

- Enter the Name of Business and PAN of the business

- Key in the Email Address and Mobile Number. The registered email id and mobile number will receive the OTPs.

- Click on Proceed

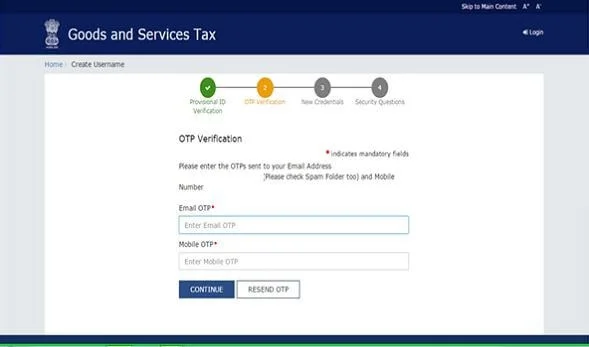

d. Enter the OTP received on the email and mobile. Click on Continue. If you have not received the OTP click on Resend OTP.

e. You will receive the Temporary Reference Number (TRN) now. This will also be sent to your email and mobile. Note down the TRN.

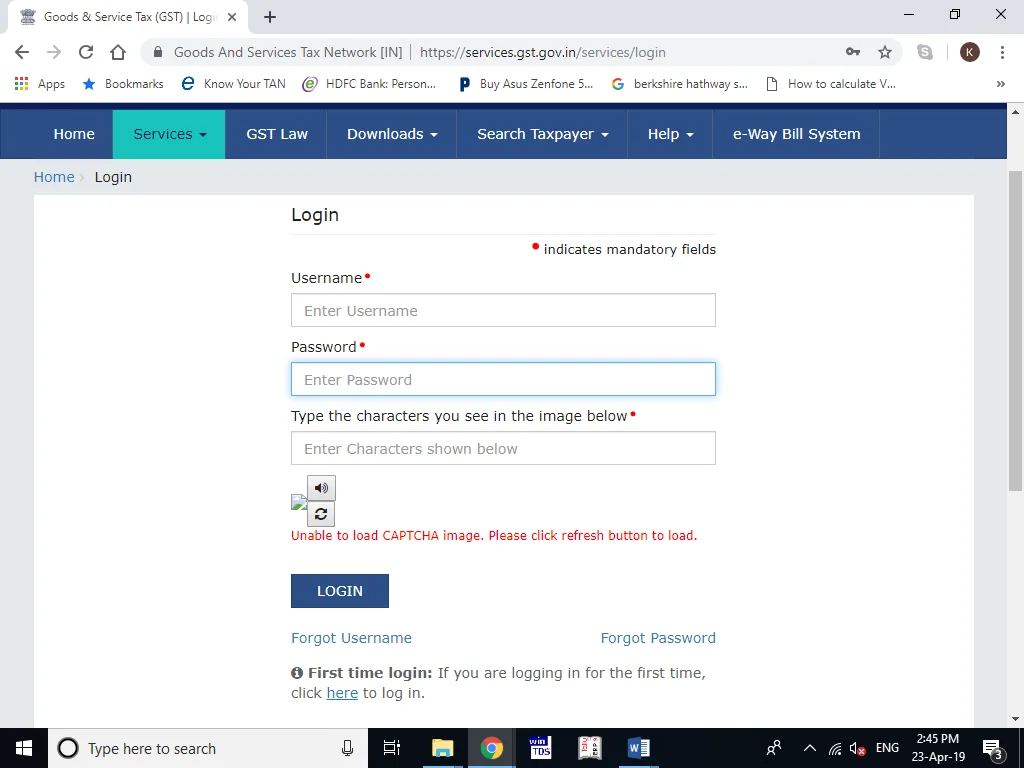

f. Once again go to GST portal. Click on Login. Click on First time login at the end of the page

g. Select Temporary Reference Number (TRN). Enter the TRN and the captcha code and click on Proceed.

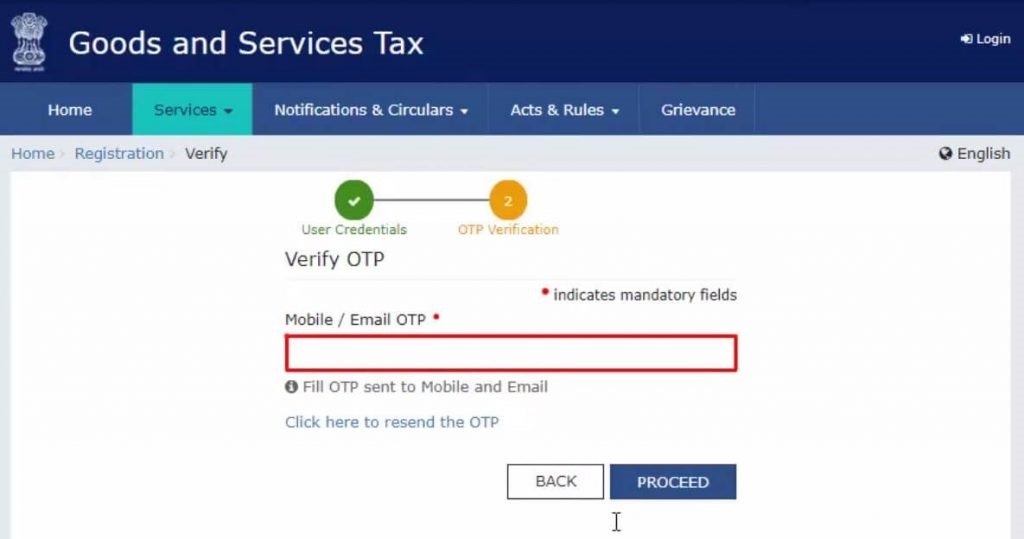

h. You will receive an OTP on the registered mobile and email. Enter the OTP and click on Proceed

- You will see that the status of the application is shown as drafts. Click on Edit Icon.

- Fill in all the details and submit appropriate documents.Here is the list of documents you need to keep handy while applying for GST registration-

- Photographs

- Constitution of the taxpayer

- Proof for the place of business

- Bank account details

- Authorization form

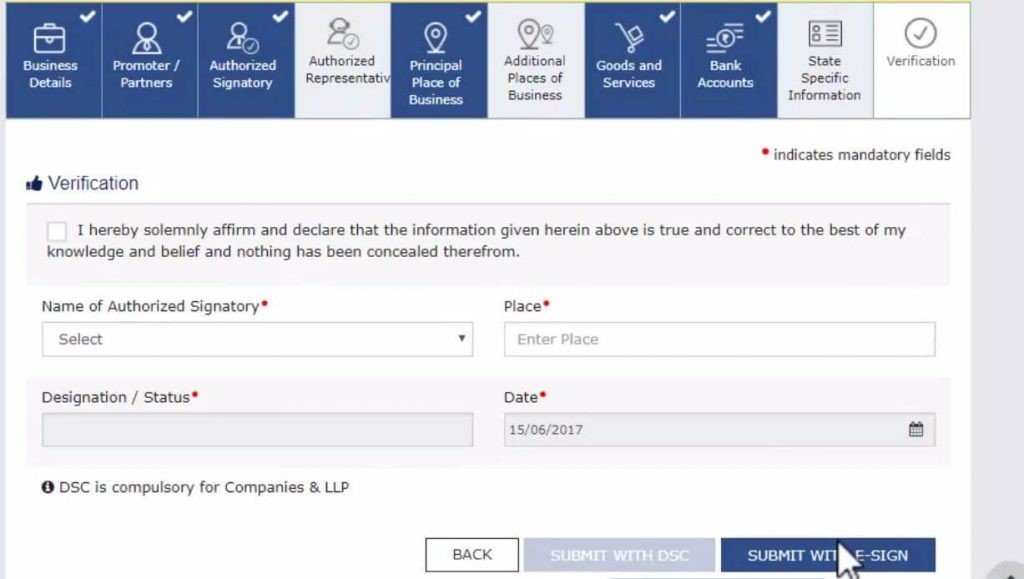

- Once all the details are filled in go to the Verification page. Tick on the declaration and submit the application using any of the following ways –

- Companies must submit application using DSC

- Using e-Sign – OTP will be sent to Aadhaar registered number

- Using EVC – OTP will be sent to the registered mobile

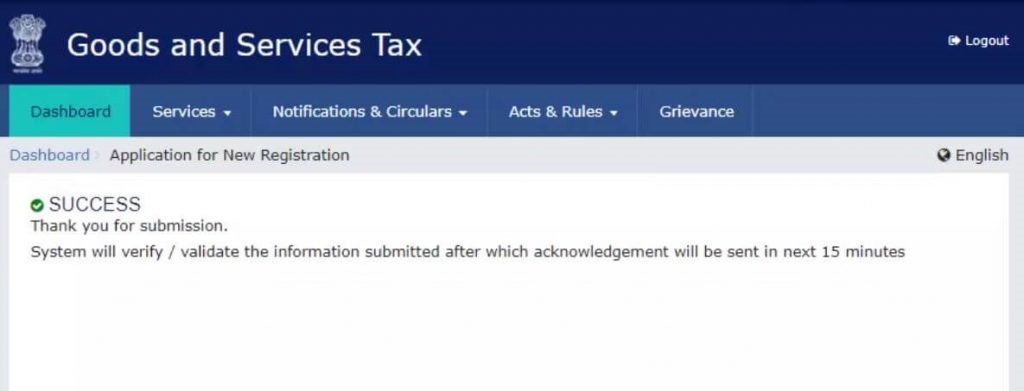

- A success message is displayed and Application Reference Number (ARN) is sent to registered email and mobile.

- You can check the ARN status for your registration by entering the ARN on https://www.gst.gov.in/

9. What is the penalty for not registering under GST?

10% of tax amount due or Rs. 10,000 whichever is higher.

However, the penalty will be 100% of tax amount is registration is deliberately not taken.

10. What are the GST rates in India?

For services it is 18% and for goods it can anywhere be between 5% to 28%